Home value depreciation calculator

Annual Depreciation Expense 2 x Cost of an asset Salvage ValueUseful life of an asset Or The double declining balance depreciation expense formula is. The four most widely used depreciation formulaes are as listed below.

Sum Of Years Depreciation Calculator Double Entry Bookkeeping

Depreciation asset cost salvage value useful life of asset.

. Ad Wondering About The Historical Value Of Your Home. It provides a couple different methods of depreciation. This calculation gives you the net return.

It allows you to figure out the likely tax depreciation deduction on your next investment property. Now that you know the basics of the property and the homes value you should also assess your origin in the place. Understanding your homes worth allows you to estimate the.

The next again year the depreciation value is 810 and so on. The value of the home after n years A P 1 R100 n Lets suppose that the. To calculate the annual rental property depreciation expense the cost basis of the property is divided by 275 years.

Depreciation Expense 2 x. Straight Line Depreciation Method. In this case he could multiply his purchase price of 100000 by 25 to get a land value of 25000.

Find Home Values Online. For every year thereafter youll depreciate at a rate of 3636 or 359964 as long as the rental is in service for the entire year. Start by subtracting the initial value of the investment from the final value.

Ad Calculate Your Homes Estimated Market Valuation by Comparing the 5 Top Estimates Now. Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae. Enter the original purchase price of your home and current estimated value to find out the the Annual Home.

Note that this figure is essentially equivalent to. Real Estate Property Depreciation Calculator Calculate depreciation used for any full year and create a depreciation schedule that uses mid month convention and straight-line depreciation. Calculate the average annual percentage rate of appreciation.

The assessors opinion of value can be found for free on most city or county websites. This is the first Calculator to draw on real properties to determine an accurate estimate. Before You Sell Find Historical Real Estate Market Rates For Your Home Online.

Using the above example your cause in the housethe. This depreciation calculator is for calculating the depreciation schedule of an asset. Check out the percentage increase of your home value with this calculator.

A 250000 P 200000 n 5. Knowing the estimated value of your own home helps you price your home for sale as a precursor to an official home appraisal. Divide the net return by the initial cost of the investment.

Calculate Rental Property Depreciation Expense. First one can choose the straight line method of.

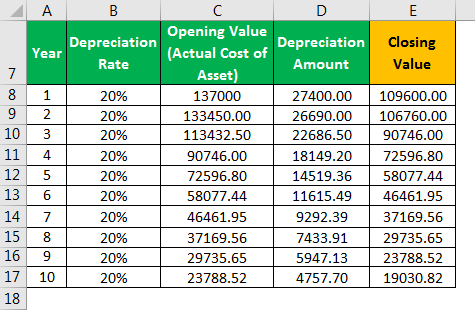

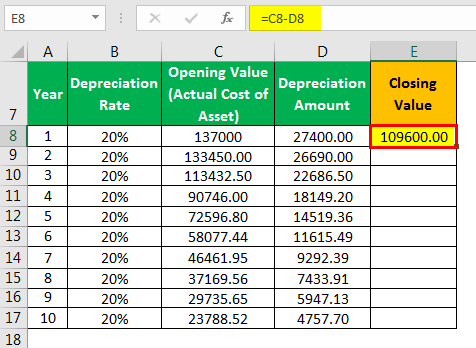

Depreciation Formula Examples With Excel Template

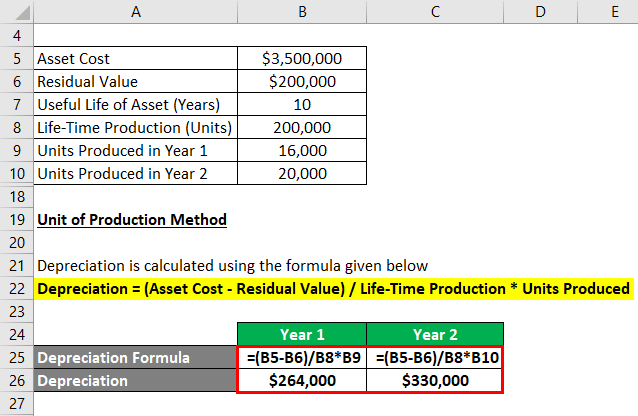

Depreciation Formula Calculate Depreciation Expense

Macrs Depreciation Calculator With Formula Nerd Counter

Depreciation Formula Calculate Depreciation Expense

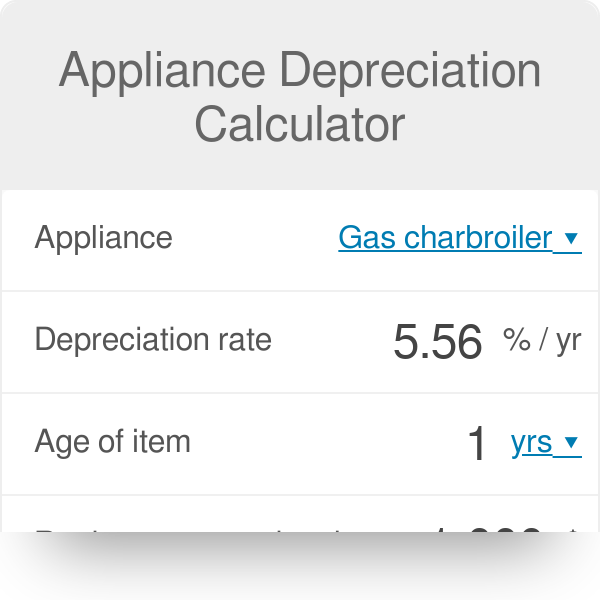

Appliance Depreciation Calculator

Depreciation Formula Examples With Excel Template

How To Use Rental Property Depreciation To Your Advantage

How To Calculate Depreciation On Rental Property

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Free Macrs Depreciation Calculator For Excel

Depreciation Formula Examples With Excel Template

Macrs Depreciation Calculator Straight Line Double Declining

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Depreciation Formula Calculate Depreciation Expense

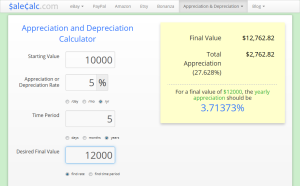

Appreciation Depreciation Calculator Salecalc Com